- Nerd Out on Business

- Archive

- Page -18

Archive

TruGolf Lost 95% of Its Value Trying to Be Three Companies at Once

Hardware manufacturer? Software licensor? Franchise operator? TruGolf is trying all three. Now facing NASDAQ delisting with just $5M market cap (down 95% since its SPAC), this golf simulator company offers a pivot that's worth following.

The Logistics Software Company That Bought Its Way to $668M Revenue

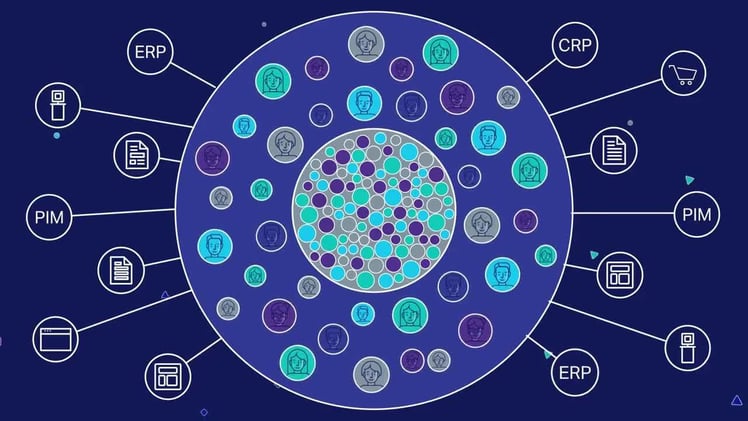

Network effects > features (sometimes). How Descartes Systems went from near-bankruptcy to $9B by becoming the platform where 24,000 logistics companies connect. New case study explores their 95% retention rate and self-funded acquisition strategy.

The $45B Distributor That Amazon Couldn't Kill (Yet?)

In 2017, leadership made a bet: transform the company before Amazon forced them to. It worked. Industrial distributor W.W. Grainger, selling everything from safety gloves to conveyor belts, has grown revenue 34% to $17.5B while defending against Amazon Business's $25B assault.

Mosaic's Ride on the Commodity Roller Coaster

The company has built a huge business by owning assets that are nearly impossible to replicate. But the company is a glaring example of cyclicality. Their revenue went from $12B to $19B to $13B in three years. Here's how they attempt to build competitive advantages while riding the commodity price rollercoaster. And I touch on their controversial push to impose duties on others.

Target's Revenue Has Stagnated: How Strong Positioning Can't Save You From Everything

Four straight quarters of sales declines. Revenue sliding from $109B to $106B. Customers fleeing discretionary spending for experiences. Yet Target's brand positioning remains one of retail's strongest moats. Inside the company that proves great strategy isn't always enough