- Nerd Out on Business

- Posts

- The S&P 500 Company Generating $6.4 Million Per Employee

The S&P 500 Company Generating $6.4 Million Per Employee

Texas Pacific Land owns 873,000 acres, employs 111 people, and generates more profit per employee than almost any company on Earth. Here's how a 136-year-old bankruptcy liquidation became the ultimate passive income machine.

Today's company profile is a bit different. Texas Pacific Land (TPL) started as a bankruptcy liquidation in 1888 and now generates more cash per employee than almost anyone.

Quick facts that caught my attention:

73,000 acres in West Texas managed by 111 employees

$706M revenue, 90% gross margins, zero debt

They collect royalties while others do the drilling

Stock up 230% in 2024 as AI companies eye their land

What makes this relevant for entrepreneurs:

They turned one asset (land) into 5+ revenue streams

Their biggest "mistake" forced them into a better business model

Patient capital actually worked (took 130 years, but still)

Shows how governance changes can unlock massive value

One thing that will be fun to follow: They're positioning 136-year-old assets for data centers and Bitcoin mining. Owning a big chunk of an energy-rich state like Texas has hard-to-foresee option value.

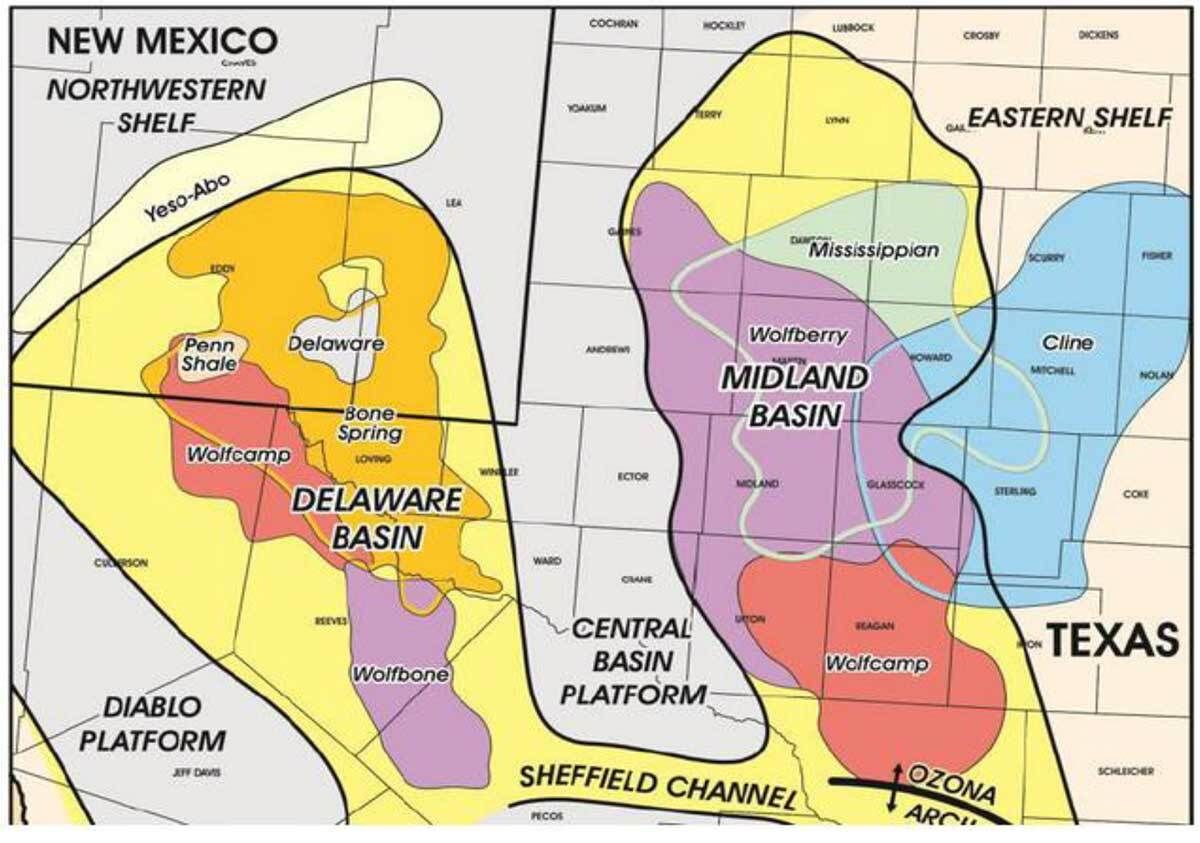

But, this business has been a huge beneficiary of the development of the most prolific oil field in modern times. It’s easy to see why they’ve been successful given their location. Eventually, oil production declines will erode the company's cash flow. When exactly, who knows!

With that, I'll talk to you tomorrow.

Nick

TL;DR

What they do: Own 873,000 acres in West Texas, collecting royalties from oil/gas production and water services without operating anything themselves

Key insight: TPL turned a 136-year-old railroad bankruptcy into a $29 billion royalty machine with 86% EBITDA margins and just 111 employees

Entrepreneurial lesson: The best business models make money while you sleep—TPL proves that owning irreplaceable assets beats operational excellence every time

Current stats: Market cap $29.25B, revenue $706M (2024), $6.4M revenue per employee, zero debt

The 30,000-Foot View

Texas Pacific Land operates as the Permian Basin's largest landlord, collecting checks from every stage of oil and gas development without drilling a single well. Think of them as owning the mall while everyone else runs the stores.

Business Model Breakdown:

Land & Resource Management (62.5% of revenue): Oil/gas royalties ($373M), easements ($63M), land sales ($4M)

Water Services (37.5% of revenue): Water sales for fracking ($151M), produced water royalties ($104M)

Key Stats:

Market Cap: $22 billion

TTM Revenue: $727.66 million

Net Income: $460.2 million (63% profit margin)

Employees: 111

Industry: Energy (Oil Royalty Traders)

Company History

1888: Texas and Pacific Railway goes bankrupt. Bondholders get stuck with 3.5 million acres of "worthless" West Texas desert

1920s: First Permian Basin oil discovery on TPL land changes everything

1954: Management spins off mineral rights to TXL Oil Corporation—a $100+ billion mistake in hindsight

2010: Fracking revolution unlocks Permian shale; TPL's land becomes America's oil epicenter

2017: Launches Texas Pacific Water Resources to capitalize on fracking's water needs

2019-2021: Epic proxy battle with activist investors led by Horizon Kinetics (23% stake)

2021: Converts from 133-year-old trust to modern C-corporation

2024: Joins S&P 500; positions land for AI data centers; stock up 230%

Show Me the Money

Standout features:

Revenue per Employee: $6.4 million (111 employees generating $706M). Higher than Apple, Google, or Microsoft

Free Cash Flow Conversion: 99%+ of operating cash flow becomes free cash flow ($461M FCF on just $29M capex)

Operating Leverage: Every $1 of new revenue adds $0.85 to operating income - among highest of any public company

Financial Data

Metric | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

Revenue | $451M | $667M | $632M | $706M |

Gross Profit | $410M | $617M | $570M | $635M |

Gross Margin | 91.0% | 92.5% | 90.2% | 89.9% |

Ops Profit | $362M | $562M | $487M | $540M |

Ops Margin | 80.4% | 84.3% | 77.0% | 76.4% |

CapEx | $16M | $19M | $15M | $29M |

Net Debt | -$428M | -$511M | -$725M | -$370M |

The N.O.O.B. Nine — Competitive Powers

The Nerd Out on Business Nine is made up of Hamliton Helmer's famous "7 Powers" of competitive advantage (Scale Economies, Network Economies, Counter-Positioning, Switching Costs, Branding, Cornered Resource, and Process Power) combined with two of my own (Data Flywheel and Distribution Advantage).

Power | Score | Rationale |

|---|---|---|

Branding | 2/5 | Known among oil operators as premium Permian landlord |

Data Flywheel | 1/5 | Minimal data advantages |

Process Power | 4/5 | Royalty model organizationally superior—no drilling risk, multiple revenue streams |

Scale Economies | 4/5 | Managing 873k acres with 111 employees creates insane operating leverage |

Switching Costs | 3/5 | Once operators build $50M facilities on TPL land, they're locked in |

Cornered Resource | 5/5 | 873,000 irreplaceable acres in world's most productive oil basin |

Network Economies | 2/5 | Water pipeline network gains value with connections, but limited |

Counter-Positioning | 3/5 | Pure royalty model that traditional E&P companies can't easily copy |

Distribution Advantage | 2/5 | No distribution needed for royalty collection |

Average Score: 2.9/5 - TPL's moat comes from irreplaceable land and superior business model, not traditional competitive advantages.

Memorable Marketing

TPL doesn't run Super Bowl ads—their marketing strategy is refreshingly simple: generate obscene profits and let Wall Street notice.

Key Positioning:

"Pure Play Permian" - Concentrated bet on America's top oil basin

CEO messaging: "We're an oil and gas company today, but we want to be an energy company of the future"

2022: Bitcoin mining partnership (60MW with Mawson) positioned TPL as tech-forward

2024: Strategic PR around AI data center potential drove 230% stock rally

Tactical Takeaways: • Sometimes the best marketing is just having a product everyone wants • B2B companies can create compelling narratives around boring assets • Scarcity messaging ("nobody has more Permian land") drives premium valuations

AI Uses & Opportunities

Current AI initiatives: • Bitcoin mining operations (60MW capacity through partnerships) • Active negotiations with major tech companies for data centers • AI-driven produced water treatment optimization

Future potential: • Land: 873,000 acres near power grids perfect for data centers • Power: Access to cheap natural gas + 700MW contracted solar • Water: Produced water can cool data centers after treatment • Location: West Texas = no NIMBYs, friendly regulations

If TPL leases just 1% of land for data centers at tech rates, revenue could double.

Bumps in the Road

Governance Drama (2019-2023): • Continuous proxy battles with activist investors • Delaware lawsuit over share authorization • $10M+ annual legal bills • Multiple board resignations

Environmental Challenges: • Permian produces 20M+ barrels wastewater daily • Deep injection wells linked to earthquakes • Texas Railroad Commission tightening regulations • Growing PFAS contamination concerns

Business Risks: • Commodity price exposure (oil crashes = lower royalties) • Can't control operator drilling decisions • All eggs in Permian basket • Trading at 52x earnings—priced for perfection

Your Swipe File

1. Own the toll road, not the trucks TPL profits from everyone on their land without operational risk. What's your industry's toll road?

2. Turn one asset into multiple revenue streams Same dirt generates royalties + water sales + easements + material sales

3. Patient capital wins TPL held "worthless" land 130 years before the payoff

4. Governance matters (eventually) Ancient trust structure worked until it didn't. Modernization unlocked $17B in value

5. High margins hide many sins With 86% EBITDA margins, you can afford inefficiency most businesses can't