- Nerd Out on Business

- Posts

- The Bus Insurance Startup That Built a $26 Billion Empire (By Serving Customers Nobody Wanted)

The Bus Insurance Startup That Built a $26 Billion Empire (By Serving Customers Nobody Wanted)

While competitors fight over car insurance scraps, Markel quietly built a Fortune 500 company insuring things like thoroughbred horses and marina operators. But here's where it gets weird: they also own 21 random businesses and manage a $34B investment portfolio.

oday, we're looking at Markel Corporation (MKL)

It's specialty insurer that's been quietly building something rather unique since 1930.

Started with Sam Markel insuring sketchy jitney buses (a small bus or car following a regular route along which it picks up and discharges passengers, originally charging each passenger five cents) in Norfolk that established insurers wouldn't touch.

Today they're a Fortune 500 company that underwrites everything from racehorses to crypto exchanges while simultaneously running a massive investment portfolio and owning 21 random businesses through their ventures arm. Think of them as somewhat similar to Berkshire Hathaway

Here's some of what I found:

How a 1930s bus insurance startup became a $26B conglomerate by serving customers nobody else wanted

Their unique three-engine model: insurance + investing + owning random businesses (plants, bakeries, crane companies)

Why they wrote a 214-word culture document in 1986 and never changed it

The CATCo disaster that should've killed them but somehow made them stronger

Key sections covered:

Financial snapshot showing how they went from $15M (1986 IPO) to $26B today

Their "anti-marketing" approach - they do professor office hours at conferences instead of booths

How they use AI to speed up quotes without firing underwriters

NOOB Nine score of 3.9/5 (strong moat from serving weird niches)

Main takeaways for entrepreneurs:

Find the customers everyone else thinks are too complicated

Build multiple revenue engines that reinforce each other

Measure success in decades not quarters

Turn your biggest weakness into a competitive advantage

One note - their marketing approach is particularly interesting. They spent $25M on "education" not advertising. I plan to dig more into that and report back.

I'lll see you tomorrow.

Nick

TL;DR

What they do: Markel runs a three-engine business model—specialty insurance (equine, crypto exchanges, summer camps), a $34B investment portfolio, and 21 wholly-owned businesses through Markel Ventures

Key insight: They built a $26B empire by serving the customers everyone else ignores, then holding those relationships (and investments) forever

Entrepreneurial lesson: Stop competing in crowded markets—find the complex, "weird" problems that make others run away, then become the world's expert

The 30,000-Foot View

Markel Group operates as a specialty insurer, investment manager, and holding company rolled into one. Their insurance operations focus on hard-to-place risks across 30+ niche markets, generating $8.5B in premiums (2024). The investment portfolio manages $34.2B, heavily weighted toward equities including a massive Berkshire Hathaway position. Markel Ventures owns 21 businesses outright—from Costa Farms to industrial equipment manufacturers—contributing $5B in revenue.

Revenue mix: Insurance (49%), Markel Ventures (29%), Investment income (22%)

Key stats:

Market cap: $26.1B

Operating margin: 19.4%

Net income: $3.0B (2024)

Employees: ~22,000

Industry: Specialty Insurance & Diversified Holdings

Company History

1930: Founded by Sam Markel in Virginia, focused on insuring jitney buses.

1951–1980: Expanded into Canada, launched Essex Insurance.

1986: IPO at $8.33/share on NASDAQ.

1990s–2000s: Moved aggressively into specialty insurance and launched Markel Ventures.

2012–2015: Acquired Alterra and CATCo; expanded globally.

2016: Tom Gayner becomes CEO, formalizes the three-engine model.

2017–2019: CATCo losses led to regulatory scrutiny and a decline in business.

2023–2024: Strong recovery; launched cyber and fintech insurance products; rebranded to Markel Group.

Show Me the Money

Standout features:

Cash exceeds debt

Combined ratio 89% (excellent)

Investment returns 20%+

Markel Ventures EBITDA margins ~15% |

Financial Data

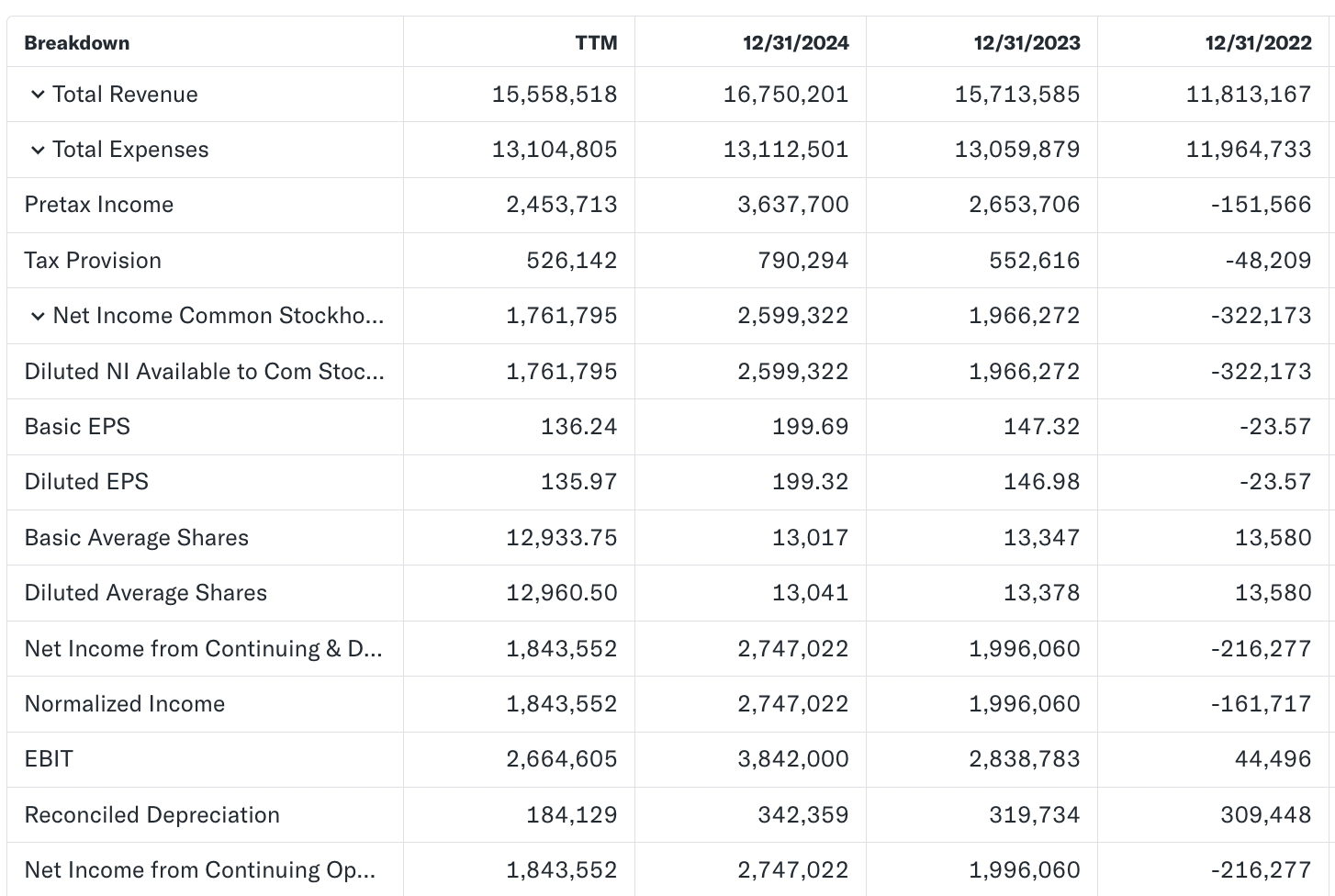

Given that this is an insurance company, it’s financials are reported differently than my standard format. So I’m pasting in their income statement from Yahoo Finance.

The N.O.O.B. Nine — Competitive Powers

The Nerd Out on Business Nine is made up of Hamliton Helmer's famous "7 Powers" of competitive advantage (Scale Economies, Network Economies, Counter-Positioning, Switching Costs, Branding, Cornered Resource, and Process Power) combined with two of my own (Data Flywheel and Distribution Advantage).

Power | Score | Rationale |

|---|---|---|

Branding | 4/5 | "The Markel Style" attracts long-term partners; 90+ year reputation |

Data Flywheel | 3/5 | Growing but not core; AI initiatives starting to structure unstructured submission data |

Process Power | 4/5 | Decentralized underwriting + permanent capital mindset = faster complex decisions |

Scale Economies | 4/5 | $8.5B premiums create underwriting leverage smaller specialty insurers can't match |

Switching Costs | 4/5 | Deep expertise in niche risks creates high barriers for clients to switch |

Cornered Resource | 5/5 | Decades of loss data in obscure niches (equine mortality, etc.) impossible to replicate |

Network Economies | 2/5 | Limited network effects; some benefit from broker relationships referring multiple lines |

Counter-Positioning | 5/5 | Three-engine model confuses competitors—insurer? investor? PE firm? |

Distribution Advantage | 4/5 | 80% through specialized brokers; relationships built over decades |

Average Score: 3.9/5 - Markel's competitive moat is formidable, built on unique positioning and specialized knowledge.

Memorable Marketing

Marketing & Brand Strategy

Markel's marketing philosophy: become the educator, not the advertiser. They position themselves as the intellectual leaders in specialty insurance through education-first content.

Notable Campaigns & Tactics:

Key campaigns/tactics:

"Risk University" Webinar Series (2023-2024)

20+ sessions on emerging risks (AI liability, cyber for manufacturers)

Channel: Digital webinars

Why it worked: Positioned Markel as thought leader; 5,000+ participants generated qualified leads

Result: 40% increase in website traffic; improved broker engagement

Industry Conference "Office Hours" (Ongoing)

Instead of flashy booths, Markel sets up "professor's office" consultation spaces

Channel: In-person events (15+ conferences annually)

Why it worked: One-on-one time with underwriters builds deeper relationships than booth scanning

Result: Higher close rates on complex accounts

Tactical Takeaways:

Teach, don't pitch - Create content that helps customers identify risks they didn't know existed

Go deep, not wide - Better to be the expert at 3 conferences than have a booth at 30

Make expertise accessible - Complex topics explained simply builds trust faster than credentials

AI Uses & Opportunities

Current Uses:

Underwriting assist tools

Claims triage automation

Investment signal analysis

Document processing (generative AI)

Customer service bots for Ventures

Future Ideas:

Predictive pricing using unstructured data (IoT, satellite, social)

AI-driven portfolio optimization

AI advisory services for clients (e.g., risk reduction tips)

Internal “AI Center of Excellence” for Ventures portfolio

Bumps in the Road

Risks & Roadblocks

Even a steady engine stalls sometimes.

2022 Investment Losses:

$1.6B+ unrealized drop crushed operating income. Rising rates hammered the values of their bond holdings but they typically hold until maturity so they expect minimal realized losses.Markel CATCo Scandal:

Major losses and regulatory fallout led to a shutdown.Regulatory Pressures:

More scrutiny on climate risk and capital reserves.Talent & Complexity:

Niche underwriters are rare; integration is messy.Investment Volatility:

Heavy equity exposure = mood swings in earnings.

Your Swipe File

Find your "jitney bus market" - What customer segment do established players refuse to serve? Complexity and "weirdness" often hide the best margins

Write your culture before your business plan - Markel's 214-word culture document has guided decisions for 40 years. What are your non-negotiable principles?

Build engines, not products - Insurance generates cash, investments compound it, ventures diversify it. Design reinforcing business models that create multiple ways to win

Measure in decades - Markel explicitly manages for 5-year periods, enabling strategies quarterly-focused competitors can't pursue. What would you do differently with patient capital?

Turn expertise into marketing - Stop advertising features; start teaching customers about problems they didn't know they had. Education builds trust faster than promotion